Banking and Finance

Finance And Banking Software Consulting Services

Innovations in financial technology are revolutionizing the way we manage and engage with our finances. With complex and constantly changing global regulatory environments to comply with and utmost importance of data and application security, choosing the right software development partner who keeps pace with the latest technology advancements within the framework of compliance and application security is critical for business success.

FinTech software solutions are different in several ways and require a stable, scalable and secure architecture, stringent data protection, high performance low latency solutions and countless third-party integrations.

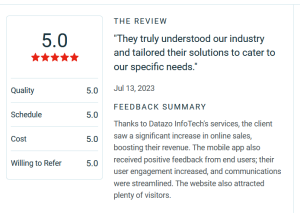

Datazo InfoTech has 5+ Yrs of experience developing, modernizing and supporting complex FinTech applications ensuring that they are fast, reliable, secure and scalable. Our expert software development, Cloud, QA, and DevOps teams with in-depth domain knowledge seamlessly blend with your business and technology processes to help solve specific technical challenges or bring innovative FinTech products to the market.

Datazo InfoTech’s Expertise ……..

Preparing for your success,

We Implement Banking Software Solutions……..

ACCOUNTING SOFTWARE

FINANCIAL SOFTWARE

INSURANCE SOFTWARE

PORTFOLIO MANAGEMENT

INVESTMENT SOLUTIONS

VCS & INVESTORS

TRADING & EXCHANGE PLATFORMS

PAYMENT PROCESSING & INTEGRATION

LEGACY MODERNIZATION

BIG DATA SOLUTIONS FOR FINTECH

AI/ML ALGORITHM DEVELOPMENT

BLOCKCHAIN SOLUTIONS FOR FINTECH

FinTech Software Development Services:

Application Security Services

With growing amounts of collected data and many fintech companies

undergoing digital transformation the security of the data and

applications are among the biggest challenged faced by finance and

banking industry.

Datazo InfoTech provides a full range of services to ensure app and data security:

Secure Architecture Design

Cloud Security Assessment

Security Code Reviews

Penetration Testing

Encryption of Data

Security Consulting

Digital Transformation

Rapidly changing market conditions and growing customer demands for service and product interconnectivity, availability and personalization are reshaping financial and banking industry and putting pressure on FinTech companies to innovate. Regardless of whether a company is a digital disruptive startup born less than a decade ago or an established enterprise catching up to digital transformation, none remain unaffected by the shift in consumer expectations and competitive landscape.

To help its clients go through a Digital Transformation efficiently or to digitize and modernize parts of the infrastructure Datazo InfoTech provides custom Digital Transformation solutions tailored to the needs of every client. And, because it is a journey, not a destination, you need an experienced team to help you take advantage of

new technologies and reap the benefits of being a digital enterprise. We promptly act on your Vision, and realize it in a Secure, Reliable and Scalable way.

Digital Transformation Services

Innovate | Power | Generation

Legacy Application Modernization

Cloud Engineering

Big Data Warehousing

Cloud Migration and Enablement

DevOps Services

Business Intelligence and Predictive Analytics Solutions

Third-Party Integration

Blockchain

Data protection and security

Hybrid workplace

Artificial Intelligence (AI)

Digital banking

Integrating best-in-class FinTechs to improve your customer lifecycle

Execute a Successful Digital Transformation

Innovate | Power | Generation

Connecting You to the World of Fintech

Datazo InfoTech builds modular banking architectures that allow you to integrate microservices and APIs with your core banking platform while reducing risk. You gain the flexibility to work with best-in-class providers and deliver the newest features to your customers. We have experience integrating with the key core banking platforms.

Our Experienced Experts

Our interview process

The first step in our interview process is to give you a quick call to learn more about you, and make sure you check all the requisite boxes. Find a quiet, comfortable place, make sure your phone works, and grab a pen and paper to take notes or sketch out ideas during the call.

Calls typically last 30-45 minutes. We encourage interviewees to think out loud and ask plenty of questions. After we wrap the call, we try to get back to candidates as soon as possible. The wait time should be no more than 2-3 weeks.

One of the best ways to see someone’s skills is to see them in action. For most roles, we ask candidates to complete a short challenge that shows off their critical thinking skills and strategic thinking.

This helps us gauge their real world experience as well as see how they solve problems within the context of the role. If the challenge is successfully completed, it becomes a core component of the on-site interview.

After the phone screen and challenge phases, we invite candidates to come hang out at the office and meet the team that they’d be working with. This is the “Formal Interview”, if you’d like to call it that. During this time, we’ll review and talk through the completed challenge and dig into the candidate’s previous experience.

It’s likely that there will be a second onsite interview that’s less formal. This meeting will be about meeting other Sidebenchers and learning about the candidate’s culture fit.

Should you continue through the hiring process to the final round of interviews, you’ll meet with Mr. M. R. Tanvir H. (Our Managing Director & CEO) and another member of our leadership team you’d likely interact with regularly once you join. These conversations allow you to get to know our leadership and ask any outstanding questions that will help you make a well-informed decision. They also enable everyone (both candidates and Datazo Info-Tech) to validate alignment on mutual expectations.

If everyone thinks it’s a good fit, we’ll make you an offer to Join Our Global Team.