The Future of FinTech Industry

The Future of FinTech Industry

In the 21st era, businesses are no longer confined to implementing old-school or traditional ways, credit to the FinTech revolution! With many options available today, companies can choose from net banking to mobile payments. FinTech is known for its cutting-edge technologies of AI and blockchain. To be more specific, financial services organizations that adopt technology in today’s market, no matter what the big winners, will be!

“At the end of the day, customer-centric FinTech solutions are going to win says Giles Sutherland.”

Note that the FinTech industries are growing at an exponential rate with the help of innovation in FinTech. Newer ideas are getting shaped into applications. These days the role of FinTech has become more defined, influential, and sound, especially for organizations looking forward to growing at a 2X rate.

Yet again, if you think you cannot keep up with the financial buzzwords from Bitcoin, and NFTs, to Ethereum, do not panic at all, as you are not the only one in the queue!! The ever-growing technology of FinTech has continuously innovated to build customized financial software solutions.

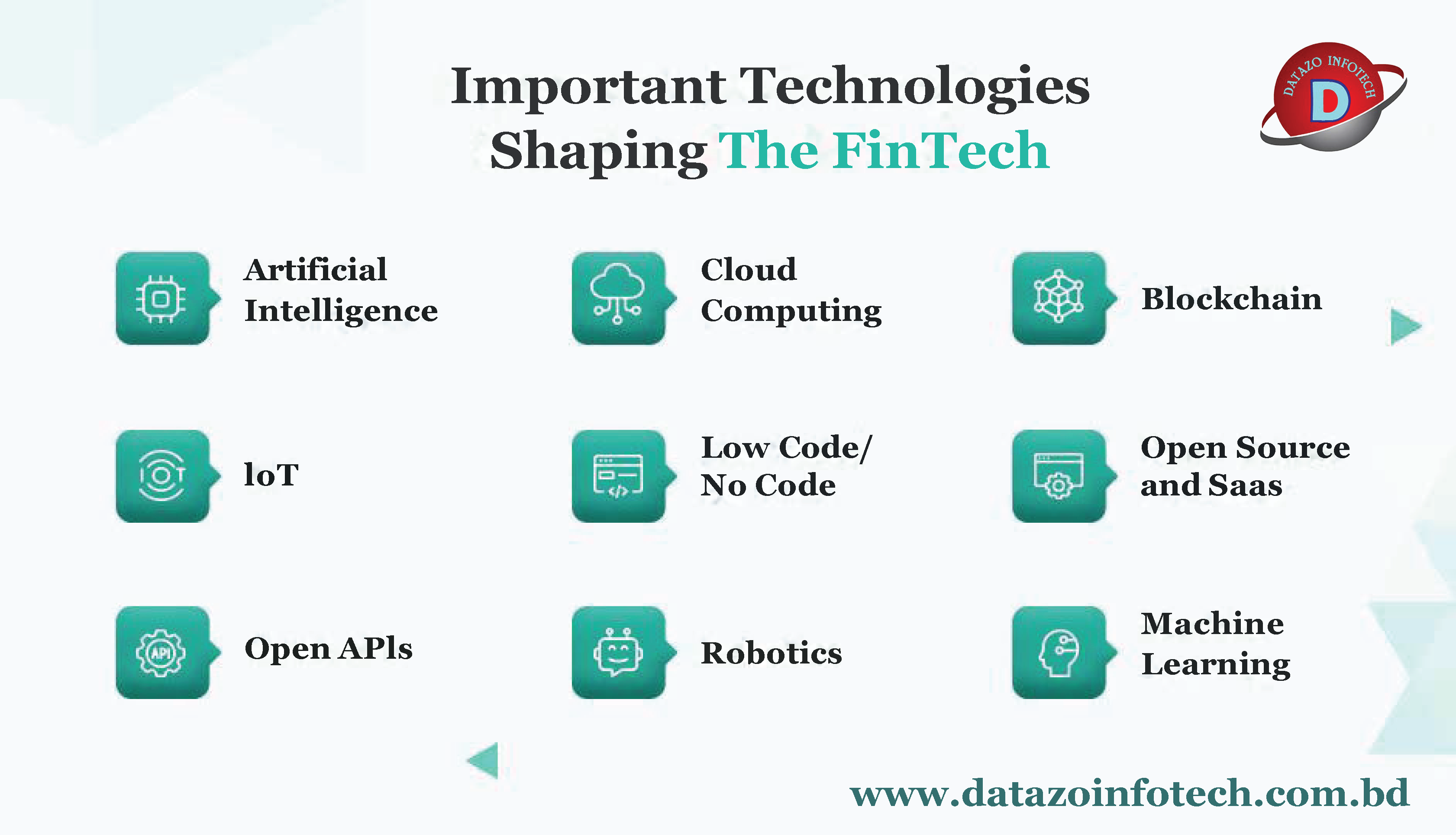

Here in this article, we will help you unleash the top technologies that will shape the future of FinTech (technologies used in FinTech) and how they can enhance your business ROI; exciting, isn’t it? Let’s dive into the same. Do you wonder what technologies will play a significant role in molding the future of FinTech?

Any idea about the same?

Think, think harder!!

Let me help you out!

Well, technologies like AI, Blockchain, Cloud Computing, IoT, and Open-Source SaaS are a few on the list of others.

Here are our checkpoints to walk through today:

What is FinTech?

FinTech, or financial technology innovation, means offering financial services over the Internet. It also means solutions or products designed to help you manage your financial matters differently.

Digital payments and financial services made possible by digital technologies are FinTech. One can implement it through digital wallets, cryptocurrency payments, e-wallets, Banking Software, and even real-time applications such as mobile payments at the ATM and online bank transfer services. And much more!

Are you an enthusiast about FinTech and want to learn about the Top Tech Fintech Trends In 2023

Moving further, FinTech is a good thing for everyone, and everyone should embrace it for its benefits!! It offers you a wide range of investment options and, simultaneously, helps manage your finances and makes it much easier for your finance management. Are you still looking for a deeper insight into what Fintech is?

Technologies Shaping the Future of FinTech

The future of the FinTech sector depends on the adoption of new technology and the digitization of the global economy. Also, as FinTech is becoming increasingly widespread globally, several technologies have been implemented to satisfy the sector’s demands. Some of these criteria are consumer expectations, governmental permissions, security upgrades, and competitiveness.

Now let us dive into the advanced technologies running the ecosystem, which have become more innovative and adaptable.

Now let us dive into the advanced technologies running the ecosystem, which have become more innovative and adaptable.

1. Artificial Intelligence

McKinsey estimates that AI technologies can potentially deliver up to $1 trillion in additional value for banks annually. So, therefore, banks and other financial industries are tipped to adopt an AI-first mindset immediately. It will better equip them to fend off technology companies’ attempts to infringe on their area.

Furthermore, according to Cambridge Center for Alternative Finance 90% of FinTech firms are already applying AI in some form. Plus, the most crucial aspect of AI is that it can learn to function more effectively and efficiently than any human can.

By learning and adapting data from data, the models of AI can perform any task without human intervention. It helps get the work done quicker, more efficiently, and more accurately, making it an intelligent choice for FinTech. To further understand, let’s examine a few applications of AI in the financial industry.

Use Cases of AI in FinTech

According to the data collected by Global Newswire, the AI market is expected to grow by $13 trillion by 2026, accelerating at a CAGR of 29.16%.

2. Cloud Computing

The integration of cloud computing enhances security with the help of automated and embedded security controls. It’s important to remember that maintaining sensitive data involves risk, especially when combined with industry restrictions.

It has been demonstrated that the cloud data warehouse is more dependable than conventional IT ecosystems. Well, because of features like zero-trust verification and data encryption, the cloud can more consistently protect against fraud and data leakage.

With the availability of cloud technology, our way of life is surely changing. It aids businesses in the best ways possible in maximizing the potential of use cases for digital transformation. It accomplishes the same thing by offering a route for secure data sharing and dynamic applications that can be used in any industry or area of the company, regardless of what you are currently doing!

Plus, the global market size of the FinTech sector is expected to grow to USD 124.3 billion by the end of the year 2025, at an annual compound growth rate forecasted to be 23.84%, according to research conducted by Global Newswire. Now let us look at the use cases of Cloud Computing.

Use Cases of Cloud Computing in FinTech

3. Blockchain

The potential of blockchain to upend the current banking system is huge. Data may be shared, recorded, and synchronized across several data repositories in real-time with the use of distributed ledger technology (DLT).

Also, blockchain tends to solve problems brought on by antiquated financial systems, like reliance on centralized systems, a lack of confidence, increased operational costs, and single points of failure. This aspect helps with other benefits by enhancing the revenue by working on the end-to-end experience and cutting down the business risks.

With the advent of blockchain, participants’ hunger for investments, including institutional investors, has increased. Not to overlook the fact that today the most progressive FinTech solutions have blockchain in their modules. Similar efforts are made to draw bitcoin fans and enter the industry.

Use Cases of Blockchain in FinTech

4. IoT

The Internet of Things is a network of physical objects that are embedded with sensors, software, and other technologies. These objects can connect to other devices and systems over the internet and share data with them.

It is to be noted that finance was one of those sectors that embraced the digital revolution first. Also, the predominant mainstay in the finance sector is the use of real-time data. To meet these requirements, the sector integrates IoT and real-time analytics.

It is difficult to imagine life today without analytics, which uses customer data to collect and analyze consumer purchasing behavior. IoT is used in the financial industry to produce useful client data. It does away with the requirement for human involvement in resolving financial problems and fraud detection.

On the latter, it offers a solid platform for data protection, among several other uses. The people who are into the niche of investments, insurers, and all others are adopting IoT in risk determination while improving customer engagement and easing out the complex claims process.

Use Cases of IoT in FinTech

5. Low Code/No Code

Low-code programming is a way to build software using a graphical user interface. It means that you can build software without writing code manually. Instead, all that you have to do is use visual symbols to represent the code blocks and integrate them using drag and drop. Software Development might be more effective and quicker with this programming.

It enables companies to react quickly to shifting commercial requirements. The reason behind the same is that the users can develop and implement their systems without waiting for professional developers to change them.

Furthermore, low code no code applications are typically less expensive than in-house systems. According to Grand View Research, the global low-code application development platform market size is expected to grow at a compound annual growth rate CAGR of 22.7% from 2022 to 2027.

For larger banks with millions of customers to target, quicker and faster solutions using no-code development will become a matter of survival. Plus, it will make it easier for the banking sector to make new products or applications within a matter of days.

Use Cases of Low Code/No-Code in FinTech

6. Open Source and SaaS

Do you know what the contemporary digital economy’s foundation for financial innovation is? Well, without any doubt, it is scalability and performance. In recent years, things like open-source architecture and software-as-a-service (SaaS) solutions have grown to be significant components of the FinTech industry. These are essential in the transition to digital. Now if you are wondering how financial services embrace digital transformation.

SaaS assists in providing apps as a service online. You will therefore be able to obtain software over the Internet rather than having to install and maintain it. You are also relieved of handling sophisticated hardware and software.

Also, it allows businesses to utilize cloud-based technology rather than downloading it. This leads to enabling the financial service sector to stay competitive. Now, because cloud-based SaaS systems are constantly updated, financial institutes make the most out of recent technology breakthroughs, i.e., with FinTech SaaS.

Use Cases of Open Source and SaaS in FinTech

7. Open APIs

The emergence of open banking is altering how society functions and engages in financial transactions, and with these open APIs and services are becoming commonplace.

By evaluating data from numerous sources, financial service providers can use open banking to provide their clients customized services. These APIs are essential for creating an intuitive user experience and protecting data via endpoints.

It is a regulatory framework to foster competition among the banks, and it helps encourage better services for the customers. The open banking feature is crucial because it provides customers with more power over their data.

Also, it enables users to access a wider variety of services from various providers, increasing competition and resulting in better prices for customers.

Use Cases of Open API in FinTech

8. Robotics

Robotics engineering is the branch of engineering that deals with the conception, creation, production, and use of robots. Wondering what is the use and goal of this technology? Well, the goal of robotics is to create machines that are intelligent and that have the tendency to support humans in different ways.

Robotics can take any form. They frequently resemble people or take the form of robotic apps, showing how people work with the software to carry out various activities.

Applications such as robotic process automation in the banking niche refer to using special software and tools to perform tasks according to the requirements. In today’s era, the technology of robotics is used in financial institutions for account opening, customer inquiry processing, and several other repetitive tasks.

Use Cases of Robotic Process Automation in FinTech

9. Machine Learning

The algorithms of machine learning used in finance work in the best ways for the identification of patterns. These algorithms also aid in the detection of relationships among numerous sequences and occurrences. Thereby helping to extract the important data hidden among the massive data sets.

The aspect of machine learning in the financial industry also opens the doors to spotting suspicious activities and helping in the best possible ways to prevent fraud. So, ML in FinTech can act as a game changer.

Not only will the aspect of ML help in data mining, i.e., facilitating the process or predicting the outcomes, but also it is supportive in risk management, strategy aggregation, strategy refinement, and trade ideas creation.

Use Cases of Machine Learning in FinTech

These are a few technologies that tend to shape the future of FinTech. Fusing the financial market with modern and cutting-edge technologies will benefit not only the companies but also the users. FinTech achieves this by giving both users and businesses a better-tailored experience.

What is the Next Massive Thing in the FinTech Industry?

Now that we have looked at the latest technologies that can help in the best possible ways to shape the future of the financial industry, it is evident that the pace of innovation in this niche will be at a 2X rate. The FinTech industry will be a perfect combination of new and old technologies. Exciting, isn’t it? Now you must want to learn about how to get started! So, here’s a Fintech App Development Guide to help you get started!

The modern technologies banks are adopting to improve customer experience will also provide users with better-customized services.

It will also help boost revenue generation in the financial service sector and assist them in maintaining their advantage over their clients. Most of all, it will encourage innovation in this niche, which is expected to lead the financial sector to a new level. The future is bright!

Conclusion

FinTech has started completely revolutionizing how we do things in today’s era. It is transforming the way we bank, how we invest money, and how we manage our investments. This blog post showcased the modern technology trends here to positively impact the financial industry by shaping its future. If you want to join this field, then fret not because there is an opportunity for everyone in FinTech, whether you are a software developer or an entrepreneur.

As a leading FinTech Software Development Company at Datazo InfoTech, we can help you develop the best FinTech app for you and your business. With 5+ years of experience, we cater to the needs of different companies and help them grow. If you want to know more about FinTech applications, contact us. With expertise in developing web and mobile apps, our team of passionate developers ensures that your business operations are seamless with our innovative ideas.